cn23 form uk

The CN23 is a customs form used when sending gifts and goods abroad worth more than 270 with Royal Mail. Become a Post Billpay biller - Accept customer payments online by phone and at Post Offices.

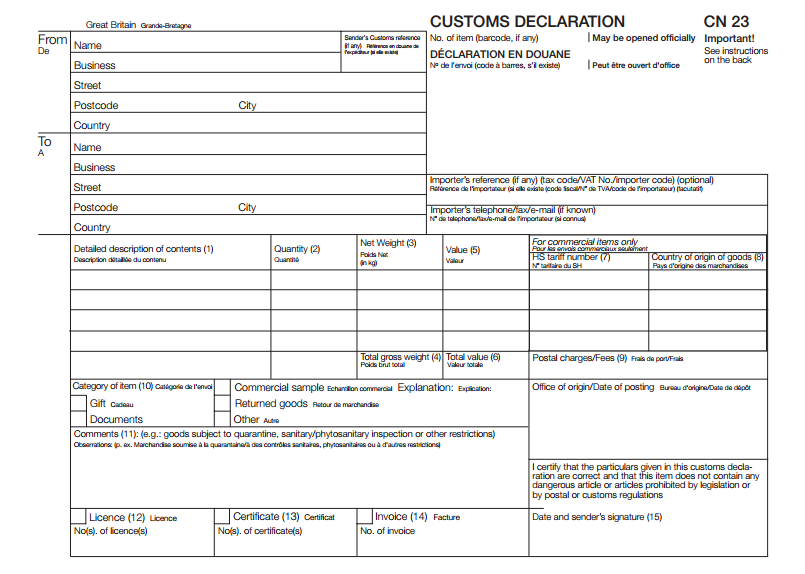

Customs Declaration Form Cn23 Fill Online Form

The CN23 form is required for shipments weighing from two to 20 kilograms or with a value of 425 or more.

. Where applicable the recipient customers in the UK. The regulations on sending to the EU are changing. Fill Customs Declaration form CN23 online form. When shipping internationally you must remember to include a commercial invoice in addition to the CN22CN23 form.

Choose New Customs Declaration Custom Declaration CN23 to bring up a new CN23 data entry form. Create this form in 5 minutes. Of item barcode if any May be opened officially Important. There are two types of customs declarations required for shipping a parcel outside of the EU.

Use professional pre-built templates to fill in and sign documents online faster. This form allows for a full description of the item its value and full contact details for the sender and recipient. Great BritainGrande-Bretagne See instructions on the back From Name De DÉCLARATION EN DOUANE No de lenvoi code à barres sil existe Peut. CN22 and CN23 documents are exclusively required when sending goods outside of the UK when shipping through the Royal Mail.

Get access to thousands of forms. In the UK Royal Mail says this should be used if you are sending packages worth over 270 while a. Fill in the address information of the sender and receiver. This will often ease the handling process for the carrier and customs so ensure both.

The information and use of this invoice functions similarly to CN22. At An Post weve built new digital tools so you can easily complete your sending documentation. I had attached the CN22 form on the front with the IOSS number and value of item clearly on front. Of item barcode if any CN 23 Detailed description of contents 1 HS tariff number 7 Country of origin of goods 8 Office of originDate of posting.

The CN23 is a customs form used when sending gifts and goods abroad worth more than 270 with Royal Mail. CUSTOMS DECLARATION CN 23 No. You must include a form PFU 509CP72 with these -. Use the CN23 customs form for packages weighing more than 2 kilograms andor valued at more than 425.

Customs forms are a mandatory requirement when shipping a package internationally with a postal carrier service such as PostNL in the Netherlands or Royal Mail in the United Kingdom. Any shipment of goods outside the European Union and Overseas Departments and Territories must be subject to a digital customs declaration. They are mandatory for all gifts and goods being sent internationally from England Scotland or Wales anywhere outside the UK if posting from Northern Ireland they are only needed for posting to non-EU destinations. CN22 FORM or CN23 or both.

The customs declaration form can be completed online on Click Post or in your local post office. You must fill in this customs declaration so that your package can be properly sent to the destination country. With the CN23 data entry form visible you have the Help Text OnOff to guide you for each field entry as well as the Instructions showhide for complete instructions. Creating a CN23 in EdgeCTP and EdgeDocs b How to fill in a CN23 Form.

Yes we have blank CN22A customs form and CN23 customs form available to download print and fill in by hand. How to create an eSignature for the cn 23 form pdf. 3162021 82714 AM. The CN23 form is similar to the CN22 but it contains more details.

International couriers such as DHL or DPD do not require a CN2223 but rather a Commercial Invoice or their own variation of a customs declaration form. When filling in a CN22 or CN23 form you need to ensure you have both digital and physical versions under the Universal Postal Unions UPU regulations and UK and EU legislation. This service may be more economical than normal postal services for. Customers sending to Great Britain will need to complete a customs declaration form CN23.

Of item barcode if any CN 23 Detailed description of contents 1 HS tariff number 7 Country of origin of goods 8 Office of originDate of posting Bureau dorigineDate de dépôt May be opened officially. Add a payment gateway SecurePay Become a Post Billpay biller - Accept customer payments online by phone and at Post Offices. Print the document download PDF or we can send you it to your email. Ad Download Or Email Form CN 23 More Fillable Forms Register and Subscribe Now.

Do I have to do both the CN22 and CN23 to items sent outside UK. The CN22 form and the CN23 and CP71 forms. Form CN23 - for contents worth more than 270 Parcels over 2kg and up to 30kg are delivered by Parcelforce. Customs forms for sending items between the EU and non-EU countries are standardized worldwide and the main form is CN23.

There is also a CP72 form which needs to be used if you are sending goods via Parcelforce. A step-by-step guide to the CN23 form. Left arrow to indicate to go back Back to Accept payments. I just recieved back a parcel from Ireland with a sticker on it saying that it was not customs compliant no CN23 form.

It contains more details than the CN22 forms like licence and certificate numbers and information on whereas the products are subject to quarantine sanitary or phytosanitary inspections. The online customs declaration is currently unavailable for flat-rate packages. Customs forms are now mandatory for all gifts and goods sent to a country outside the UK except when sending items from Northern Ireland to the EU.

What Are The Cn22 And Cn23 Customs Declarations And How To Use Them

What Is A Customs Declaration Cn23 And How To Complete It Edgectp

The Customs Form Made Easy Step By Step Guide For Cn23 Byrd

The Customs Form Made Easy Step By Step Guide For Cn23 Byrd

What Is A Customs Declaration Cn23 And How To Complete It Edgectp

Posting Komentar untuk "cn23 form uk"